- Kenya has raised its 2025/26 budget estimates to KSh 4.26 trillion, an increase from the prior fiscal year’s KSh 3.98 trillion, while projecting revenues of KSh 3.39 trillion.

- The government plans to allocate KSh 3.1 trillion for recurring expenditures, KSh 725.1 billion for developmental initiatives, and KSh 436.7 billion for county distribution.

- The education sector will be allocated the highest portion of the budget with KSh 701 billion; however, as Treasury PS Chris Kiptoo pointed out, even this sum does not meet the field's true monetary requirements.

Elijah Ntongai, who works as a journalist for Mountaintraveller.co.ke, possesses more than four years of expertise in financial, business, and technological research and reporting. He offers valuable perspectives on both local Kenyan developments and international patterns.

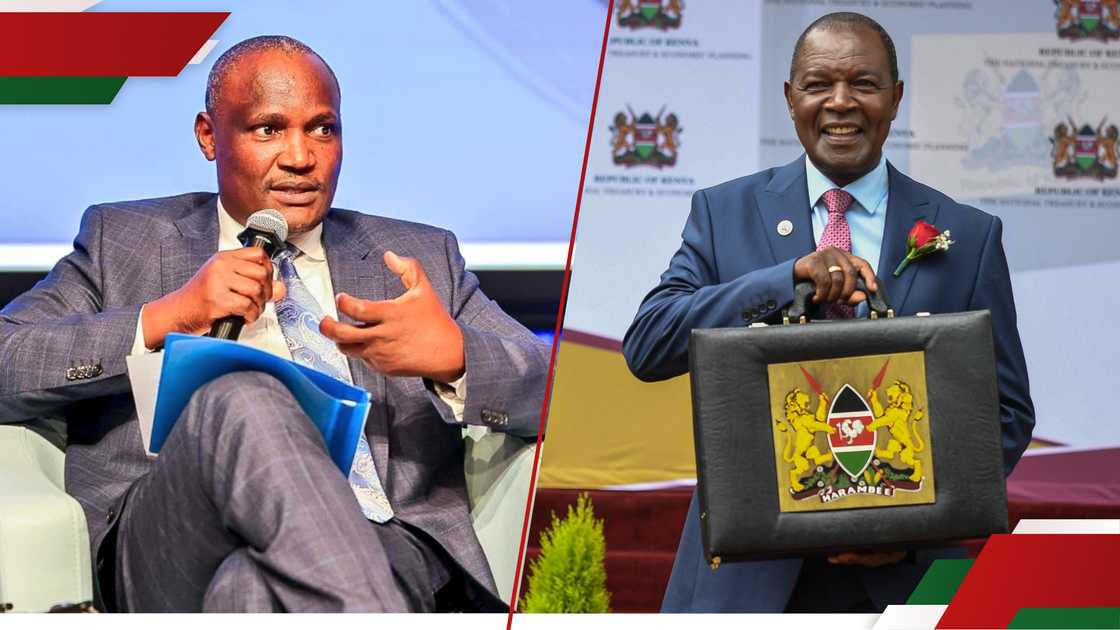

The National Treasury and Economic Planning Ministry has formally declared that Cabinet Secretary John Mbadi will deliver his inaugural national budget address for the fiscal year 2025/26 on Thursday, June 12, 2025.

As stated in a public announcement from the ministry, the budget address will commence in the parliament at 3 pm, which is a notable achievement for Mbadi, having been named the head of the treasury in late 2024.

The much-anticipated budget arrives as the administration faces increasing pressure to tackle significant economic challenges such as escalating public debt, elevated joblessness, and a cost of living crisis impacting numerous Kenyan citizens.

Different stakeholders across multiple industries will keenly observe the strategies employed by Mbadi’s Treasury for resource distribution and fostering economic expansion.

Mbadi, an experienced political figure and ex-Minority Leader in the National Assembly, is anticipated to lay out the administration's financial strategy goals, taxation initiatives, and developmental schemes.

What might be anticipated in the 2025/26 financial plan?

Earlier, Mountaintraveller.co.ke it was reported that the National Treasury unveiled the 2025/26 Budget Policy Statement, increasing the overall budget projections to KSh 4.26 trillion from KSh 3.98 trillion in the prior financial year.

The forecasted revenue stands at KSh 3.39 trillion, with ordinary revenue anticipated to reach KSh 2.84 trillion, bolstered by the current tax reform initiatives.

The government intends to allocate KSh 3.1 trillion for ongoing expenses, KSh 725.1 billion for development projects, and KSh 436.7 billion for county transfers.

The Treasury Principal Secretary, Chris Kiptoo, stated that the suggested budget for the fiscal year 2025/2026 places emphasis on education, allocating the highest portion of funds amounting to KSh 701 billion.

He pointed out that even with this budgeting, it does not fully meet the requirements within the educational sphere. He underscored significant portions like KSh 377 billion set aside for teacher compensation, KSh 55 billion allocated for free day secondary education funding, KSh 41 billion earmarked for HELB, along with provisions designated for university bursaries, subsidies for junior and primary schooling, support for intern instructors, student meals programs, and technical vocational training initiatives.

Even with higher expenditures, the fiscal deficit is anticipated to decrease to KSh 831 billion, financed via both internal and external debt.

The Finance Bill of 2025 suggests multiple alterations to taxation policies. These include increasing the limit for travel allowances, revising the terminology related to pensions, and broadening the scope of taxes on digital earnings. The aim is to improve fairness and adherence to tax regulations.

Posting Komentar